Home owners shouldn't be the only ones with insurance coverage for their belongings.

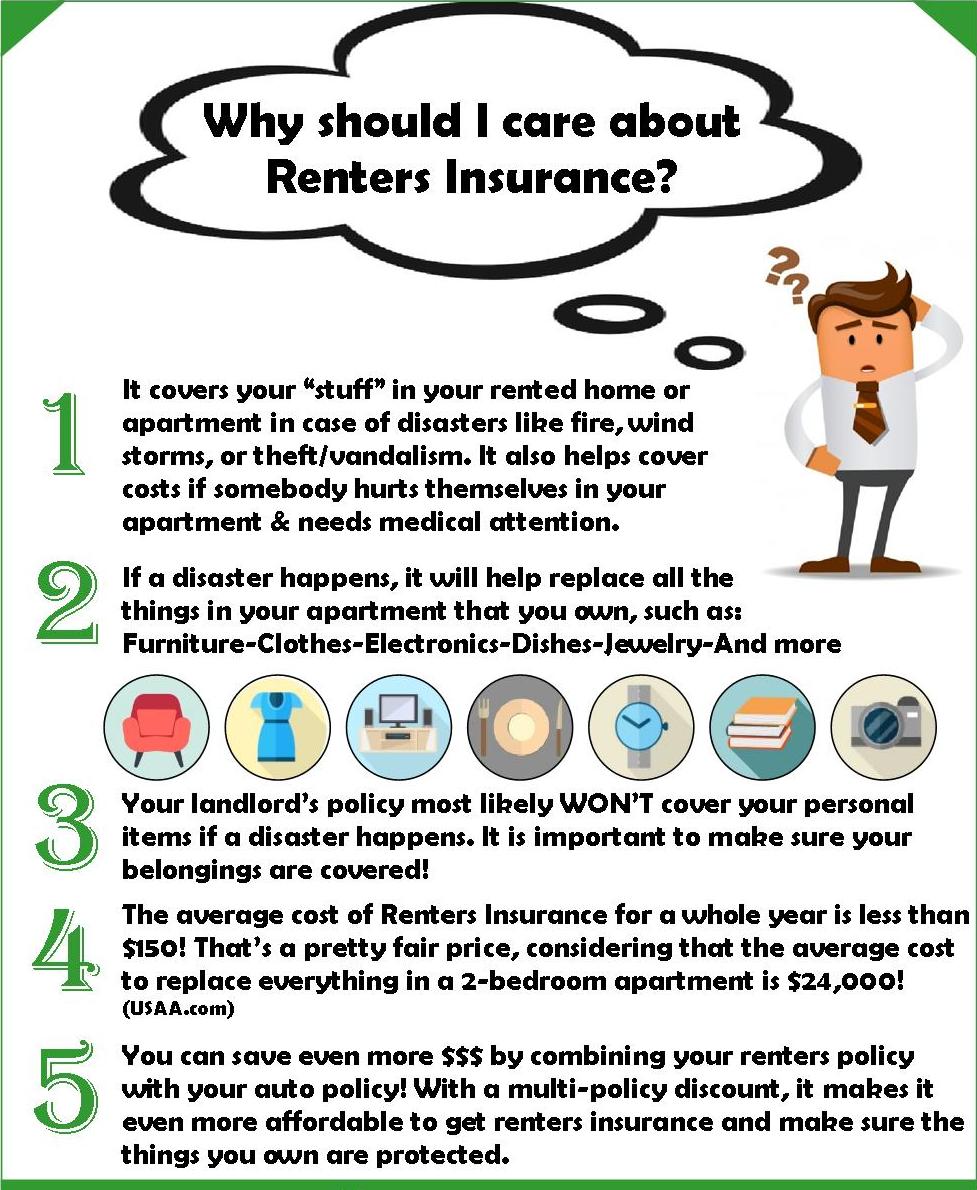

Renters Insurance is a great option for anyone who rents the space where they live. Even if you don't own a home, you should still have coverage for all your personal belongings. Renters Insurance is specifically designed to provide much more affordable coverage than homeowners insurance, and it covers your personal items, medical expenses if someone is injured at your home, and even hotel expenses if you need a place to stay after a disaster. Keep in mind that when you rent an apartment, house, or condo, the landlord has insurance on the building itself, but most often does NOT provide any coverage for your personal belongings.

Our renters insurance policies offer a variety of advantages, including:

- Multiple policy discounts for people who insure their vehicles with the same company

- Affordable policies that are quick & easy to set up

- 24-Hour Claims Hotline

- Flexible billing options

Special coverage we would suggest:

- Replacement cost coverage for your contents

- Increased liability limits of at least $300,000, and at least $5,000 of medical payments coverage

- Scheduled coverage for higher-value items like guns, antiques and jewelry

FAQ - RENTERS

Personal Property

Imagine picking up your house, turning it upside down, and giving it a good shake. Everything that falls out would be the items covered under the Personal Property limit. This is the bread and butter of the renters policy. It covers all personal items like clothes, kitchen items, furniture, and electronics in the event of a loss from a covered peril, like fire, theft, vandalism, or wind storms.

If you're like most people, the things you have in your apartment have been accumulated over the course of many years. Suddenly being faced with paying to replace all of those things all at once is a daunting idea to consider, especially since according to USAA.com, the average cost to replace everything in a 2-bedroom apartment is $24,000. The minimum coverage for personal property on a renters policy is usually $15,000-$20,000, but you can raise it as necessary to cover the items you own, usually for only a few extra dollars per year.

- Replacement Cost Coverage pays for losses to your possessions at the cost of brand new items without depreciation, so long as you actually replace the item.

- If you have an art collection, antique furniture, jewelry, guns, expensive electronics, or other valuable possessions, you should consider adding extra coverage such as fine arts or scheduled property endorsements, to adequately protect your investment in these items. The cost is modest for the extra protection, and often there is no deductible

- As with homeowners policies, we recommend preparing an inventory of personal property items, updating it periodically, and keeping it in a safe place outside your home, such as a safe deposit box at your bank or on the cloud. It will save you hours of time trying to list everything damaged or destroyed if you need to make a claim. It will also help ensure you don't forget some items. We can advise you on ways to simplify the job of preparing a personal property inventory such as videotaping each room with descriptive information on the sound track.

Liability

Besides making sure you have enough protection to cover damage to your contents, you should also evaluate your exposure to liability risks. Liability risks include the possibility of damage to the someone's property, or injury to a person who is not a member of your household, for which you are responsible.

- The Personal Liability coverage provided by your Renters Policy usually provides a limit of at least $100,000 or $300,000. We strongly recommend a minimum of $300,000 as a base coverage level. If you have any appreciable assets, we suggest serious consideration be given to the purchase of a separate umbrella policy since the liability area is where you have the least control over the size of a potential loss.

Medical Payments

The medical payments coverage works in the same way on a renters policy as it does on a homeowners policy. If somebody is visiting your home and gets injured, the medical payments limit will pay for medical bills associated with the injury regardless of fault.

The standard minimum Medical Payments limit is only $1000. We recommend raising that to the maximum available, $5000. The $1000 limit just doesn't go very far during a trip to the doctor or ER in this day and age, and the cost to raise that limit is only a few dollars per year.

Read your policy! Certain property such as jewelry, guns or recreational vehicles (snowmobiles, ATVs & boats) may be better insured by endorsements or by providing a separate policy for them. Most renters insurance policies will not provide coverage for licensed or DNR permitted units since they are not considered contents. Thus, units such as ATV's, motorcycles, snowmobiles, antique autos, parked autos, and boats should have separate insurance policies or be specifically listed on the renters policy. Certain perils, such as earthquake or flood, are not covered under most standard renters insurance policies and coverage for these items if desired may require a separate policy. Knowing what is covered and for how much will help you maximize the value of your insurance expenditures. If there is anything in your policy you don't understand, give us a call and we can discuss it with you.

At each annual renewal of your policy, you receive a new Policy Declarations page showing limits of coverage and optional coverage. Review this information carefully. If you have made any significant changes such as moving or purchasing items that require coverage, please tell us so your policy can be updated to reflect your current needs.

Review your policy coverage annually to ensure you have all the protection you need.